Amortization expense formula

The NPER function aids us to know the number of periods taken to repay. With the above information use the amortization expense formula to find the journal entry amount.

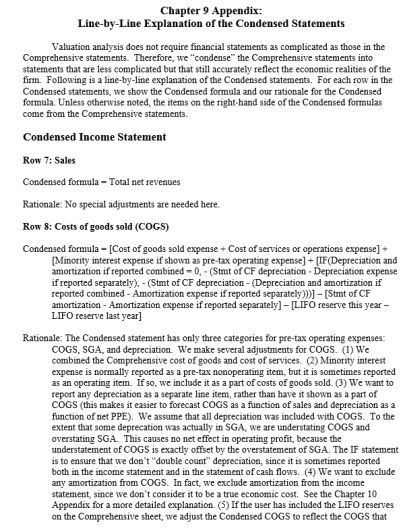

Myeducator Accounting Education Accounting Accounting Classes

Following are the importance.

. Unlike the first formula which uses operating income the second formula. This is the cost of the fixed asset. Also determine the total depreciation and amortization expense of the period.

The next thing to do is to multiply your principal amount with the monthly interest rate. The first step is to convert the yearly interest rate into a monthly rate. I have the following columns in my spreadsheet and would like to insert a formula that will automatically update all of the applicable months with the correct amount.

EBITDA Net Income Taxes Interest Expense Depreciation Amortization. For loans the amortization formula is more complex. The Depreciation formula uses the Deprecation formula to spread the assets cost over its useful life thereby reducing the huge expense burden in a single year.

Record the amortization expense in the accounting records. Here is the step by step approach for calculating Depreciation expense in the first method. Create a journal entry at the end of the year to recognize the expense.

However most financial institutions and lenders. Debit Amortization Expense - 10000 Credit Accumulated Amortization - 10000. Initial value residual value lifespan amortization expense.

NPER Rate PMT PV 3. The accounting for amortization expense is a debit to the amortization expense account and a credit to the accumulated amortization account. Hi I am trying to create a dynamic prepaid expense amortization template with a formula that can be used for.

With the above information use the amortization expense formula to find the journal entry amount. Calculate the total operating expenses incurred by the company during the year. The general syntax of the formula is.

Initial value residual value lifespan amortization expense. The expense would go on the income statement and the accumulated amortization will show up. Amortization Expense Assets Cost Assets Useful Life.

612 0005 per month. Completing the calculation the purchase price subtract the residual value is 10500 divided by seven years of useful life gives us an annual depreciation expense of.

Fcff Formula Examples Of Fcff With Excel Template Cash Flow Statement Excel Templates Formula

Ifrs 16 Transition Series For Lessees Example 2 Transitional Amortization Schedule Journal Entries

Depreciation Vs Amortization Top 9 Amazing Differences To Learn Accounting Notes Accounting Basics Instructional Design

Ebit Vs Ebitda Differences Example And More Financial Modeling Bookkeeping Business Accounting Education

Income Statement Template 40 Templates To Track Your Company Revenues And Expenses Template Sumo Income Statement Statement Template Income

The Freedom Formula How To Turn 244 000 Into 1 4m In 14 Years Investing Architect Investing Debt Service The Freedom

Loan Payment Spreadsheet Budget Spreadsheet Spreadsheet Mortgage Amortization Calculator

Pin On Financial Education

Depreciation Journal Entry Step By Step Examples Journal Entries Accounting Basics Accounting And Finance

Accounting Principles Money Management Advice Accounting Principles Accounting Education

Earnings Before Interest Tax Depreciation And Amortization Ebitda Defination Example Financial Statement Analysis Financial Statement Income Statement

Ev To Ebitda Meaning Formula Interpretation And More Enterprise Value Money Management Advice Learn Accounting

Accelerated Depreciation Method Accounting Basics Accounting And Finance Accounting Education

Ebitda Formula Accounting Education Finance Printables Saving Money Budget

Pin On Business Iders

Times Interest Earned Formula Advantages Limitations In 2022 Accounting And Finance Financial Analysis Accounting Basics

Accounting Equation Chart Cheat Sheet In 2022 Accounting Payroll Accounting Accounting Basics