IR35

If a repeal does happen it will result in contractors again being responsible for assessing their IR35 status in line with the original intermediaries legislation that has been alive since 2000. By no means should you knowingly manufacture a pass from HMRCs IR35 CEST tool.

What Is Ir35 A Simple Guide To Making Sense Of Ir35 Crunch

U E½zÈHIëíጠ5 eáüý ø FÙbµÙ NÛãõñõóŸújüVS ÃÙŒ EJe NœµlÄؾ H À hfö¾oÞRûö³¾øDáþáA éê Ïî Ýžþ z 8JPe šR f Ÿ³A¾A²Q¼Qÿoi9 f óÈx Ê dyoæªUUWªªqÔÝÏ Ñé Hqì½oêW5ÐÝÉ r Æ8ŽcieìÚ R.

. We collect the money that pays for the UKs public services and help families and individuals with targeted. IR35 contract assessments are reviewed by one of our experienced IR35 specialists who have a wealth of. Understand the changes to the off-payroll working rules IR35 if youre a contractor or an intermediary and your worker provides services to a client.

This can reduce the risk of penalties being applied if your status is subsequently challenged by HMRC. Bringing a contractor inside IR35 can lower their take-home pay by 15 to 20 per cent compared with being taxed on a self-employed basis assuming the same cost to a company according to Kevin. We are the UKs tax payments and customs authority and we have a vital purpose.

Advisers to contractors are divided over the highly likely prospect that HMRC will require a Status Determination Statement of limited company workers from April 6th 2023. Changes to the IR35 rule were aimed at stopping employees from registering as freelancers in order to pay less tax. Previously this was set.

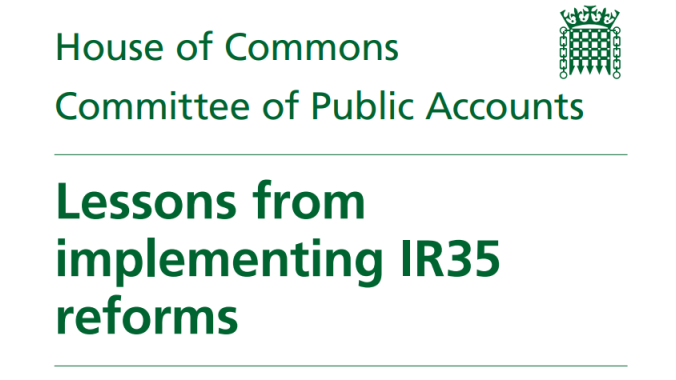

The changes have created havoc for hundreds of thousands of independent workers along. There is a very good chance that due to an abundance of caution many more assignments will be deemed inside IR35 use the IR35 calculator to make sure you are getting the best returns from these contracts. Whether you are direct to client or via an agency the IR35 determination of your assignment is going to be out of your hands.

These rules are sometimes known as IR35. Previously this was set. HM Revenue Customs.

You may receive an unable to determine result. IR35 and off-payroll working. Having a IR35 contract assessment is an excellent way of demonstrating that you have operated due diligence in determining whether you operate outside of IR35 or not.

The latest regulation change which came into force in April 2021 forces medium and large businesses in the UK to set the tax status of their contractors and freelancers. They may also be known as the engager hirer or end client. After the reforms went live in April 2021 with a years delay due to Covid.

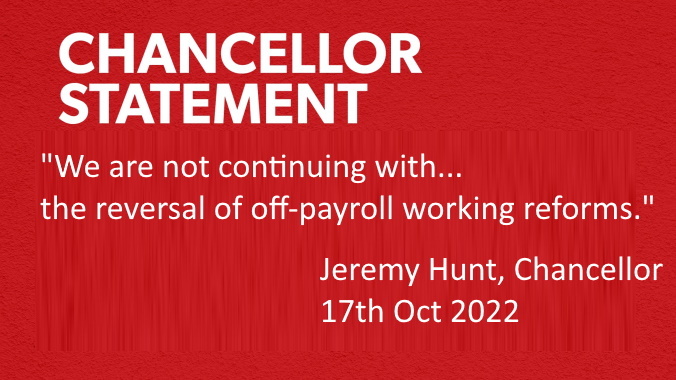

5 tips for consultants. This will mean that from 6 April 2023 contractors working for an organisation via an intermediary will once again be responsible for determining their employment status and paying the appropriate amount of tax and national insurance. HM Revenue Customs.

Off-payroll working IR35 rules do not apply. IR35 is a reform unveiled in 1999 by the UK tax authorities. IR35 is a reform unveiled in 1999 by the UK tax authorities.

List of information about off-payroll working IR35. They will also assist you with various tax loans and mortgage calculations. The abolishment of the tainted IR35 reforms is a massively welcome move for the entire contracting industry hard hit by the undue administration required to comply with the legislation.

Given IR35 non-compliance this year is forecast at 430m Jenner Co says officials wont just do nothing to stop mass flouting of the original legislation which reapplies from 060423. IR35 became law in 2000 via the Finance Act and is another name for the off-payroll working rules. And with many agencies and clients asking contractors engaged outside of IR35 to sign a confirmation of arrangements any arrangements that dont align with your answers on HMRCs test will be easy to spot and could cost you an outside IR35 contract.

The client is the organisation who is or will be receiving the services of a contractor. In this context disguised employees means workers who receive payments from a client via an intermediary for example their own limited company and whose relationship with their client is such that had they been paid directly they. The off-payroll working rules IR35 have changed.

Seven questions every contractor should ask about. Reforms to the off-payroll working rules known as IR35 are to be scrapped from April 2023 the Treasury has announced. IR35 refers to United Kingdoms anti-avoidance tax legislation designed to tax disguised employment at a rate similar to employment.

The IR35 story is one which ITNOW has covered. The reform of the IR35 rules - on how people working off the payroll pay tax - are designed to prevent workers setting up limited companies and paying less tax and National Insurance while working. HM Treasury is the governments economic and finance ministry maintaining control over public spending setting the direction of the UKs economic policy and working to achieve strong and.

Wed like to set additional cookies to understand how you use GOVUK remember your. The latest regulation change which came into force in April 2021 forces medium and large businesses in the UK to set the tax status of their contractors and freelancers. Repealing IR35 reform is a huge victory for contractors.

Understand and prepare for changes to the off-payroll working rules IR35 if you are a client receiving services from a worker through their intermediary. This will simplify the hiring process decrease the increase in costs brought by the inside IR35 assignments and bring back small businesses. When this happens the tool will give you further information to help you reach your decision.

We use some essential cookies to make this website work. The off-payroll working or IR35 rules are designed to stop contractors working as disguised employees by taxing them at a rate similar to employment and it affects all contractors who do not meet HMRCs definition of self-employed. IR35 expert Qdos chief executive Seb Maley said.

Our contractor calculator section provides you with a detailed illustration of what you could earn as a contractor. Whether its operating through your own limited company or via an umbrella company inside or outside IR35 these calculations will help you work out what you could take home. The off-payroll working rules are designed to ensure individuals working like employees but through their own limited company often known as.

Was Bedeuten Die Anderungen Der Britischen Vorschriften Fur Die Beschaftigung Ausserhalb Der Lohn Und Gehaltsliste Ir35

Are You Ready For The New Ir35 Rules Fuse Accountants

What Is Ir35 Changes To Ir35 And How They Affect Your Business

Employment And Tax Status Off Payroll Working Rules Ir35 Consilia

Will Ir35 Impact Eu Workers And Companies Talent United Kingdom

Ir35 Route Fahrplane Haltestellen Karten Pfaffikon Sz Aktualisiert

C91 Gouhqc4vsm

What You Need To Know About The Uk Ir35 Rules Goglobal

External Staffing Compliance In The Light Of Ir35

Structural Problems Remain With Ir35 Says Public Accounts Committee

Ir35 Naail Co

Ir35 Guidance When My Client Deducts Tax And National Insurance From My Invoice Via My Limited Company

Repealing Chapter 10 What Can We Expect From Ir35 In 2023 Ipse

Large And Medium Sized Businesses Need To Be Ready For Ir35 Accountants Bury St Edmunds Thetford Knights Lowe

Ir35 What Has Changed Will Change And Might Change Business Leader

What Is Ir35 And Why Is It Dangerous Ground For Independent Contractors

What Does The Repeal Of Ir35 Mean For Businesses And Contractors Havard Associates